Narrative

The Strategy Toolkit - August 2023 edition

Excerpt: Know Your Capabilities (The business case, and the simple steps to follow) - part two

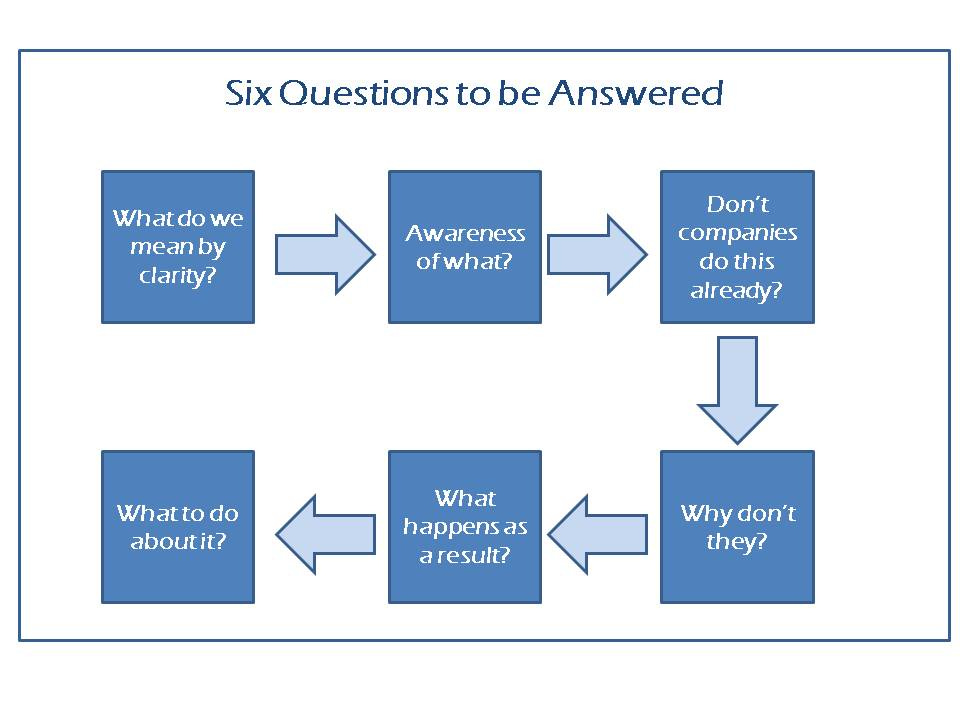

In part one (see July 2022 edition), we answered the first three of six straight-forward questions in order to make the case that you should want to know your capabilities:

We continue here with the answers to the remaining three questions.

Why don’t they?

As we pointed out in the introduction, there exists a continuous tension between inner reason and instinct within the minds of most leaders. This tension very often results in putting to one side the logic of knowing (and having) capabilities, for the sake of following gut instinct.

This leaves most companies prone to the errors of false optimism and false pessimism.

For example, there is “the capability as commodity” fallacy, resulting in what we call in Silicon Valley the tendency to do “IFTTT”.

IFTTT (pronounced “ift” as in “gift”) stands for “IF This, Then That”, a simple but powerful tool popular amongst software developers as a recipe for connecting two disparate digital activities.

For example, you can tie a trigger like “if a person tags a photo on Facebook” with an action “then send me a text message.”

In strategy, we too often see this form of IFTTT: a company realises it lacks a certain capability necessary for a given strategy, so it goes out and buys it. “If my company lacks a capability, then I can just buy it.”

This is the “capability as commodity” fallacy, an under-appreciation of just how difficult it is to build and maintain a capability for the long term (let alone attempt to buy one and expect it to flourish within your firm).

Some recent M&A deals illustrate this fallacy well (think Nike buying Umbro, Vivendi buying Activision, the Washington Post acquiring Forney, Eisai buying MGI Pharma, Yahoo! buying Tumblr, etc., etc.).

Some observers believe that one of the main reasons for the failure rate in M&A is missing capabilities and the reflex reaction of back-filling.

And this fallacy is just one response to the challenge of managing a company for the long term. Any investment geared towards boosting a firm’s long term competitive position will come into conflict with the forces demanding short term profits. Companies that are in it for the long haul recognise that capabilities are not commodities. They are, in effect, “the secret sauce” of the firm, as that banking CEO earlier put it.

To everyone’s credit, there has not been, until now, a simple way to bring capabilities into the analytics of corporate strategy. Remember, it wasn’t until Michael Porter introduced his five forces that companies included competitive factors in their financial models on a consistent basis either.

For there is an information asymmetry between a company’s financial system and its systems for understanding capabilities. Even corporate talent systems, one element of capabilities, are at an early stage of quantification. But, as Billy Beane demonstrated in his management of the Oakland A’s baseball team, there is progress being made in how companies challenge assumptions about talent, in terms of what it can and should be.